Beyond the Numbers: The Psychological Impact of Bitcoin Price Fluctuations

Bitcoin's price swings are notorious, and the emotional responses they elicit can be profound. For instance, during the remarkable ascent of Bitcoin prices—from around $1,000 in early 2017 to nearly $20,000 by December of the same year—many investors experienced overwhelming excitement and optimism. This surge created a sense of euphoria, leading to irrational exuberance, where the thrill of potential gains blinded investors to the risks involved. Conversely, when prices plummeted in early 2018, crashing to approximately $3,200, the emotional fallout was equally intense, characterized by fear, panic, and despair. Investors often abandon rational analysis during these emotional peaks and valleys, making decisions that can deviate significantly from sound economic principles.

Fear and Greed: The Twin Drivers of Market Behavior

Fear and greed are two of the most powerful emotions shaping market behavior, particularly in the volatile world of cryptocurrency. During bullish trends, greed can drive investors to act irrationally, succumbing to FOMO (Fear of Missing Out). The 2017 Bitcoin boom serves as a prime example, where rampant speculation and media hype led many to invest at inflated prices, driven by the fear of missing out on potential profits. On the flip side, fear can trigger panic selling during market downturns. Investors, overwhelmed by the prospect of losing value, may hastily sell their holdings in a bid to cut losses. The dramatic 2018 crash demonstrated this phenomenon vividly; many investors who bought during the euphoric highs panicked as prices fell, exacerbating the decline and leading to further losses.

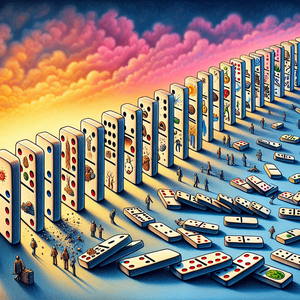

The Herd Mentality: Following the Crowd

The herd mentality plays a significant role in shaping investor behavior in the Bitcoin market. When individuals observe others buying or selling Bitcoin, they may feel compelled to do the same, often without conducting their own due diligence. This collective behavior can lead to market bubbles and crashes, as seen during the 2021 bull run. The influence of social media platforms like Twitter and Reddit became apparent, where bullish sentiment could spread rapidly, driving up prices. Conversely, negative sentiment could lead to swift sell-offs. A striking parallel can be drawn with the GameStop short squeeze in early 2021, where collective action fueled by online communities drove stock prices to unprecedented heights. Similar dynamics are observable in the Bitcoin market, highlighting the power of social influence on investor behavior.

Coping with Volatility: Strategies for Investors

To navigate the psychological impacts of Bitcoin price fluctuations, investors can adopt strategies to mitigate emotional decision-making. Here are several approaches: 1. Educate Yourself: Knowledge is essential. Understanding market trends, historical data, and the technology behind Bitcoin can empower investors to make informed decisions rather than emotional ones. 2. Set Clear Goals: Establishing a defined investment strategy with clear objectives can help investors stay focused, reducing the impulse to react impulsively to market changes. 3. Diversify Investments: Spreading investments across various assets can alleviate the emotional burden tied to Bitcoin's volatility, as losses in one area may be offset by gains in another. 4. Limit Exposure: Investors should consider capping their exposure to Bitcoin based on their risk tolerance. This can help mitigate the emotional pressure to respond to market fluctuations.

The psychological impacts of Bitcoin price fluctuations are intricate and deeply linked with investor behavior. Fear, greed, and herd mentality significantly influence market trends, leading to both opportunities and potential pitfalls for investors. By comprehensively understanding these emotional drivers, investors can enhance their decision-making processes and better navigate the tumultuous landscape of cryptocurrency trading. As Bitcoin continues to evolve, focusing on the psychological aspects of investing will remain crucial in fostering a healthier, more informed market environment, ultimately paving the way for more sustainable growth in the world of digital assets.

Behavioral Finance Analyst

Financial institutions, investment firms, fintech companies, academic research institutions

Core Responsibilities

Analyze investor behavior and sentiment trends related to cryptocurrency markets, particularly Bitcoin.

Develop models to assess the impact of psychological factors on market movements.

Prepare reports and presentations that summarize findings for stakeholders.

Required Skills

Strong understanding of behavioral finance principles and market psychology.

Proficiency in statistical analysis and data modeling tools (e.g., Python, R).

Experience with qualitative research methods and investor surveys.

Cryptocurrency Market Researcher

Crypto exchanges, market analysis firms, investment advisory companies

Core Responsibilities

Conduct in-depth research on current trends within the cryptocurrency market, focusing on Bitcoin's volatility and investor behavior.

Monitor social media and community discussions to gauge market sentiment.

Collaborate with marketing and product teams to provide insights that drive strategic decisions.

Required Skills

Familiarity with cryptocurrency technologies and market dynamics.

Strong analytical skills and experience with data analysis tools (e.g., Excel, Tableau).

Excellent communication skills for presenting findings to diverse audiences.

Digital Asset Portfolio Manager

Hedge funds, family offices, cryptocurrency investment firms

Core Responsibilities

Manage a diversified portfolio of digital assets, including Bitcoin, while assessing risk and market volatility.

Develop and implement investment strategies based on market psychology and trends.

Regularly review and adjust portfolio allocations in response to market changes and investor sentiment.

Required Skills

In-depth knowledge of cryptocurrency markets and trading strategies.

Strong financial acumen, including risk management and performance analysis.

Certification such as CFA or CAIA is advantageous.

Social Media Analyst for Cryptocurrency

Marketing agencies, cryptocurrency exchanges, financial news outlets

Core Responsibilities

Analyze social media trends and sentiment surrounding Bitcoin and other cryptocurrencies.

Create reports on how social dynamics influence market behaviors and price fluctuations.

Engage with online communities to understand investor sentiment and behavioral patterns.

Required Skills

Expertise in social media analytics tools (e.g., Brandwatch, Hootsuite).

Strong writing and communication skills for summarizing trends and insights.

Basic understanding of cryptocurrency and blockchain technology.

Risk Management Consultant - Cryptocurrency

Consulting firms, investment banks, regulatory bodies

Core Responsibilities

Assess and mitigate risks associated with investing in cryptocurrencies, particularly focusing on behavioral risks.

Develop risk management frameworks and strategies tailored to digital assets.

Educate clients on the psychological factors that can impact investment decisions.

Required Skills

In-depth knowledge of risk management principles and financial regulations related to cryptocurrencies.

Strong analytical and problem-solving skills.

Effective communication abilities to convey complex concepts to clients.