Breaking Down the Gender Pay Gap in Wealth Management

The gender pay gap in wealth management is more than just a number; it represents deep-seated systemic issues within the industry. Current data reveals that, on average, women in wealth management earn approximately 20% less than their male counterparts for comparable roles. This disparity can often be traced back to several interrelated factors, including the underrepresentation of women in senior positions, inequalities in client portfolio assignments, and divergent negotiation practices.

Root Causes of the Disparity

One of the most significant contributors to the gender pay gap in wealth management is the underrepresentation of women in leadership positions. According to a 2022 study by McKinsey, only 22% of C-suite executives in financial services are women. This lack of representation not only impacts salary levels but also reinforces a culture that often undervalues the contributions of female professionals. The absence of women in decision-making roles perpetuates systemic biases that can inhibit the advancement of their male counterparts.

Client Assignments and Portfolios

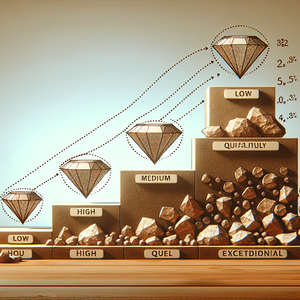

In wealth management, the size and quality of a portfolio can greatly influence earnings. Unfortunately, women frequently find themselves assigned to smaller accounts or are less often given the opportunity to manage high-net-worth clients. This discrepancy can arise from biases in client selection processes or limited access to influential networking opportunities, which their male peers might benefit from. According to industry reports, women are often assigned to less lucrative accounts, further entrenching the pay gap.

Negotiation Practices

Research shows that women are less likely than men to negotiate their salaries and promotions. Societal expectations and the fear of backlash can discourage women from advocating for themselves. This reluctance to negotiate can result in significant long-term financial disadvantages, as raises and promotions compound over time. In a sector where compensation can be heavily influenced by individual negotiation, this gap becomes particularly pronounced.

Personal Stories and Experiences

To provide a human dimension to the statistics, we spoke with several women working in wealth management. Sarah, a mid-level wealth manager, recounted her experience of being consistently overlooked for high-profile clients, attributing this to unconscious bias within her firm. "I often find myself in meetings where my ideas are dismissed or attributed to my male colleagues. It feels like I have to work twice as hard to prove my worth," she shared. Another professional, Lisa, emphasized the challenges she faced during salary negotiations. "When I asked for a raise, I was met with resistance, while my male peers seemed to have no issue negotiating higher salaries. It’s frustrating to feel like I need to justify my worth more than they do," she explained. Such personal stories reveal the deeply ingrained biases and barriers that women face in the wealth management industry.

Potential Solutions for Closing the Gap

Addressing the gender pay gap in wealth management necessitates a multifaceted approach. Firms should actively create pathways for women to attain senior roles through mentorship programs, leadership training, and sponsorship initiatives. By elevating more women to decision-making positions, the industry can begin to shift cultural perceptions and practices. Research indicates that increased representation of women in leadership correlates with improved organizational performance and employee satisfaction.

Transparent Salary Structures

Establishing transparent salary structures can empower women to negotiate their worth more confidently. Firms can implement clear guidelines for compensation that are openly communicated to all employees. By reducing ambiguity and bias, organizations can help create a more equitable environment where salary negotiations are based on merit rather than gender.

Encouraging Negotiation Skills

Training programs focused on negotiation skills for women can equip them with the tools to advocate for themselves effectively. By fostering a culture of negotiation, firms can contribute to leveling the playing field. Organizations can also provide workshops and resources aimed at teaching women how to negotiate effectively, helping them overcome barriers to salary discussions.

The gender pay gap in wealth management is a multifaceted issue deeply rooted in historical, cultural, and structural inequities. By examining the contributing factors and amplifying the voices of women in the industry, we can begin to understand the challenges they face. However, it is not solely the responsibility of women to navigate these obstacles; the financial sector must take proactive steps to cultivate an equitable environment. By promoting women into leadership roles, establishing transparent salary structures, and encouraging negotiation, we can work toward a more inclusive wealth management sector where pay equity is not merely an aspiration but a tangible reality.

Wealth Management Advisor

JPMorgan Chase, Morgan Stanley

Job Description

Develop and manage investment strategies for high-net-worth clients, focusing on portfolio diversification and risk management.

Build strong client relationships through regular communication, financial reviews, and personalized service.

Required Skills

Strong analytical abilities

Excellent communication skills

Deep understanding of financial markets

Certifications such as CFP or CFA are often preferred.

Common Employers

Major financial institutions like JPMorgan Chase

Morgan Stanley

Boutique wealth management firms

Diversity and Inclusion Consultant in Financial Services

Deloitte, PwC

Job Description

Assess and improve organizational practices to promote diversity within wealth management firms, focusing on gender equity.

Develop training programs aimed at reducing unconscious bias and fostering an inclusive workplace culture.

Required Skills

Strong knowledge of HR practices

Experience with change management

Ability to analyze diversity metrics

Background in behavioral psychology or human resources is advantageous.

Common Employers

Consulting firms like Deloitte and PwC

Large financial institutions with established diversity goals

Client Portfolio Manager

Job Description

Oversee and optimize a portfolio of client investments, making strategic recommendations based on market trends and client objectives.

Collaborate with financial advisors to align investment strategies with clients' financial goals and risk tolerances.

Required Skills

Proficiency in financial modeling

Excellent analytical and problem-solving skills

Familiarity with portfolio management software

CFA designation is often required.

Common Employers

Investment management firms

Banks

Private equity firms

Financial Analyst in Wealth Management

Job Description

Conduct in-depth analyses of market conditions and investment opportunities to support wealth management strategies.

Prepare detailed reports and presentations to communicate findings to senior management and clients.

Required Skills

Strong quantitative skills

Proficiency in financial analysis tools (like Excel)

Ability to interpret complex financial data

Degree in finance or economics is typically required.

Common Employers

Financial advisory firms

Banks

Investment firms

Compensation and Benefits Analyst

Job Description

Analyze and develop compensation structures to ensure equitable pay practices within wealth management firms.

Conduct salary benchmarking studies to identify disparities and recommend adjustments to promote pay equity.

Required Skills

Strong analytical skills

Proficiency in HRIS and compensation software

Solid understanding of labor laws

Experience in compensation strategy development is beneficial.

Common Employers

Large financial institutions

Human resources consulting firms

Corporate finance departments