From Adventure to Affluence: Tim Sheehy's Unique Investment Strategies

Tim Sheehy’s investment philosophy is rooted in a deep understanding of market dynamics combined with a willingness to embrace the unconventional. Unlike traditional investors, who may rely heavily on established market practices and historical data, Sheehy has consistently demonstrated an ability to think outside the box. His strategies often involve a mix of calculated risks and innovative approaches, allowing him to navigate volatile markets with agility and foresight.

Embracing Risk Management

One of the cornerstones of Sheehy's investment strategy is his approach to risk management. While many investors shy away from high-risk opportunities, Sheehy sees potential where others may see peril. He emphasizes comprehensive research and analysis before making significant investments. For example, during the early stages of the tech boom, many investors were hesitant about the market’s stability. In contrast, Sheehy recognized the long-term potential of tech startups. By conducting thorough due diligence and leveraging his network, he identified promising companies and invested at opportune moments, leading to substantial returns. This ability to evaluate risk versus reward has been instrumental in his financial successes.

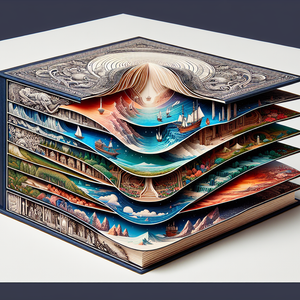

The Power of Diversification

Another essential element of Tim Sheehy's strategy is diversification, which he champions as a key tactic for mitigating risk. His portfolio is a testament to this principle, featuring a broad array of investments across various industries, including technology, real estate, and renewable energy. This diversification allows Sheehy to balance the highs and lows of individual sectors, ensuring that a downturn in one area does not significantly impact his overall financial health. For instance, during the recession, while traditional markets struggled, Sheehy’s investments in renewable energy proved resilient and even thrived. This showcased the benefits of a well-rounded investment approach, allowing him to weather economic storms more effectively than many of his peers.

Spotting Emerging Trends

Tim Sheehy also excels in his ability to spot emerging trends before they gain widespread recognition. His keen market insight enables him to identify shifts in consumer behavior and technological advancements that may not yet be on the radar of mainstream investors. For instance, Sheehy made early investments in e-commerce platforms and digital payment solutions, positioning himself advantageously as these sectors exploded in popularity. By remaining ahead of the curve, Sheehy not only maximizes his returns but also establishes himself as a thought leader in the investment community. His knack for recognizing nascent opportunities has been a defining feature of his investment journey, contributing significantly to his wealth.

Learning from Tim Sheehy's Strategies

Aspiring investors can glean several valuable lessons from Tim Sheehy’s journey. First and foremost, it is crucial to approach investing with a mindset that embraces calculated risks. Understanding that risk can lead to significant rewards—when managed wisely—is essential for anyone looking to grow their wealth. Additionally, diversifying investments across various sectors can safeguard against market volatility, providing a more stable financial foundation. Finally, cultivating a habit of continuous learning and market awareness can help investors identify emerging trends and opportunities that others may overlook.

Tim Sheehy’s unique investment strategies offer a refreshing perspective on wealth building. By embracing risk management, diversifying his portfolio, and staying attuned to market trends, he has achieved financial success and paved the way for aspiring investors to follow in his footsteps. As the investment landscape continues to evolve, the lessons drawn from Sheehy’s journey serve as invaluable guidance for anyone looking to navigate the complexities of financial growth. Whether you are a seasoned investor or just starting, adopting these principles can help you embark on your own journey from adventure to affluence. With the right mindset and strategies, financial prosperity is not just a distant dream but a tangible goal within reach.

Investment Analyst - Emerging Markets

Goldman Sachs, BlackRock

Core Responsibilities

Conduct in-depth research and analysis of emerging market economies, identifying trends and investment opportunities.

Prepare detailed reports and presentations to support investment decisions made by senior management.

Monitor macroeconomic indicators and political developments that could impact investment strategies.

Required Skills

Strong understanding of financial modeling and valuation techniques.

Proficiency in data analysis tools (e.g., Excel, Bloomberg).

Excellent written and verbal communication skills for presenting findings to stakeholders.

Portfolio Manager - Renewable Energy Investments

NextEra Energy, Brookfield Renewable Partners

Core Responsibilities

Develop and manage investment strategies focused on renewable energy projects and companies.

Analyze the financial health and growth potential of various renewable technologies (solar, wind, etc.).

Engage with companies and stakeholders to assess investment opportunities and risks.

Required Skills

Expertise in financial analysis specific to the energy sector.

Strong negotiation and relationship management skills.

Understanding of regulatory policies affecting renewable energy markets.

Risk Management Specialist - Financial Services

JPMorgan Chase, Citigroup

Core Responsibilities

Evaluate and monitor potential risks associated with investment portfolios and market strategies.

Develop risk assessment frameworks and implement strategies to mitigate identified risks.

Collaborate with investment teams to ensure compliance with regulatory requirements and internal policies.

Required Skills

Strong analytical skills with experience in quantitative risk modeling.

Familiarity with financial regulations and compliance frameworks.

Excellent problem-solving abilities and attention to detail.

Financial Consultant - E-commerce Investments

McKinsey & Company, BCG

Core Responsibilities

Provide strategic advice to clients looking to invest in e-commerce platforms and technologies.

Conduct market assessments to identify viable investment opportunities in the digital space.

Monitor industry trends and consumer behavior to inform investment strategies.

Required Skills

Experience in digital marketing and e-commerce analytics.

Strong interpersonal skills for client interactions and presentations.

Ability to translate complex data into actionable insights.

Market Research Analyst - Technology Sector

Gartner, Forrester Research

Core Responsibilities

Analyze technology trends and consumer preferences to provide insights for investment strategies.

Conduct competitive analysis to identify potential investment targets within the tech industry.

Prepare comprehensive reports and forecasts based on research findings.

Required Skills

Proficiency in statistical software and data visualization tools (e.g., Tableau, SPSS).

Strong analytical and critical thinking abilities.

Excellent written communication skills for report writing and presentations.