The Art of Activism: Bill Ackman's Approach to Activist Investing

At the heart of Ackman's investment philosophy lies the belief that publicly traded companies can be significantly enhanced through strategic intervention. Unlike traditional investors who adopt a passive investment style, activist investors like Ackman take a proactive stance, often acquiring large stakes in companies to influence management decisions and board dynamics. Ackman's approach is marked by meticulous research, a keen grasp of corporate governance, and an openness to engage in public discourse to shape opinions and decisions.

Case Study 1: Target Corporation

One of Ackman's most prominent activist campaigns took place with Target Corporation in 2007. Recognizing a disconnect between the retail giant's operational strategies and its market potential, Ackman pushed the company to undertake several transformative initiatives, including divesting its real estate holdings and refocusing on its core retail operations. Although Target's management initially resisted these changes, Ackman's persistent advocacy culminated in a shift in the management team and a renewed emphasis on enhancing customer experience and operational efficiency. The outcome was a remarkable resurgence in Target's stock price and a more nimble business model that aligned with contemporary retail trends, showcasing the potential for shareholder activism to effect positive change.

Case Study 2: Canadian Pacific Railway

Ackman’s involvement with Canadian Pacific Railway (CP) further exemplifies his activist investing strategy. In 2011, he acquired a 14% stake in the struggling railway company and called for significant changes in leadership and operational strategy. Ackman contended that CP was underperforming relative to its competitors and that a new CEO could unlock substantial value. After a protracted public battle, Ackman succeeded in replacing the CEO with Hunter Harrison, a highly regarded figure in the industry. Under Harrison's leadership, CP experienced a dramatic turnaround, demonstrating how targeted activism can yield tangible improvements in corporate performance and shareholder value.

Case Study 3: Valeant Pharmaceuticals

Perhaps one of Ackman’s most controversial cases involved Valeant Pharmaceuticals, where his initial enthusiasm for the company turned into a cautionary tale. Ackman championed Valeant as a transformative player in the pharmaceutical sector and invested heavily in the company. However, as scandals surrounding drug pricing and corporate governance emerged, his position became increasingly precarious. This case highlights the inherent risks associated with activist investing; while Ackman aimed to influence positive change, the outcome underscored the volatility and unpredictability of the sector. Ultimately, Ackman suffered significant losses on his Valeant investment, illustrating that even the most astute investors can misjudge a company's trajectory.

The Broader Impact of Activism

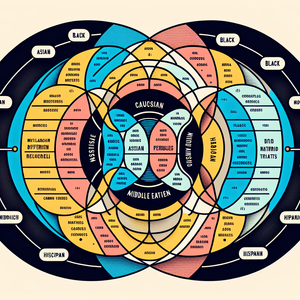

Ackman’s activist endeavors have broader implications that extend beyond individual companies. His campaigns have ignited debates regarding the role of shareholders in corporate governance, prompting discussions about management responsibilities, accountability, and the impact of shareholder activism on long-term business strategies. Critics argue that such activism may lead to short-term thinking, while proponents contend that it encourages companies to adapt and innovate in a rapidly changing market environment. This dynamic illustrates the complex relationship between investors and corporate management, highlighting the necessity for a balanced approach to governance and shareholder engagement.

Bill Ackman’s approach to activist investing exemplifies the dual-edged nature of influencing corporate behavior. Through strategic interventions, he has facilitated significant changes in companies like Target and Canadian Pacific, confirming that well-researched activism can unlock substantial value. However, his experience with Valeant serves as a stark reminder of the risks and challenges inherent in the pursuit of influence. As the landscape of corporate governance continues to evolve, Ackman’s journey reflects the complexities of balancing investment interests with ethical considerations and the long-term health of the companies in which he invests. Ultimately, the art of activism remains a potent tool in the hands of investors willing to champion change, navigate challenges, and seek out opportunities for growth, ensuring that the practice of activist investing remains relevant in today's corporate ecosystem.

Corporate Governance Analyst

Institutional investors, investment firms, and corporate governance consulting firms

Core Responsibilities

Analyze corporate governance structures and practices of companies to identify areas for improvement.

Prepare detailed reports that assess the effectiveness of board performance and executive compensation.

Engage with stakeholders, including shareholders and management, to advocate for best practices in governance.

Required Skills

Strong understanding of corporate governance principles and regulatory requirements.

Proficiency in financial analysis and modeling.

Excellent communication skills for articulating complex ideas to diverse audiences.

Activist Investor Relations Specialist

Activist hedge funds, public relations firms specializing in finance, and investment advisory firms

Core Responsibilities

Develop and execute communication strategies for activist investors to effectively convey their value propositions to stakeholders.

Monitor and analyze media coverage and shareholder sentiment regarding targeted companies.

Collaborate with financial analysts to prepare presentations that articulate the activist's vision for change.

Required Skills

Expertise in public relations, particularly in financial markets.

Strong analytical skills to assess investment opportunities and risks.

Ability to navigate complex negotiations and stakeholder dynamics.

Investment Fund Manager (Activist Focus)

Hedge funds, private equity firms, and investment management companies

Core Responsibilities

Manage a portfolio of investments with a focus on activist strategies to influence corporate management and governance.

Conduct thorough due diligence on potential investment targets, assessing both financial and operational aspects.

Lead shareholder proposals and campaigns to drive change within targeted companies.

Required Skills

Deep understanding of financial markets, corporate finance, and valuation techniques.

Experience in strategic planning and operational analysis.

Strong negotiation and advocacy skills, with a track record of successful activism.

Financial Analyst (Activist Investing)

Investment banks, asset management firms, and activist hedge funds

Core Responsibilities

Conduct comprehensive financial analysis to support investment decisions and activist campaigns.

Evaluate the potential impact of proposed changes on company valuations and shareholder returns.

Monitor financial performance of targeted companies, providing insights and recommendations for strategic action.

Required Skills

Proficiency in financial modeling and valuation techniques (e.g., DCF, comparables).

Familiarity with regulatory frameworks surrounding shareholder activism.

Strong quantitative and qualitative analytical skills.

Strategic Consultant (Corporate Activism)

Consulting firms specializing in finance, corporate governance advisory firms, and investment boutiques

Core Responsibilities

Advise activist investors on strategies to engage with companies and influence change.

Conduct market research to identify trends and potential targets for activism.

Develop tailored strategies to enhance shareholder value and operational performance for client portfolios.

Required Skills

Background in strategic management or corporate finance.

Excellent research and analytical skills, with the ability to synthesize complex data into actionable insights.

Strong interpersonal skills to effectively manage client relationships and stakeholder engagements.