The Psychology Behind Bitcoin Price Fluctuations

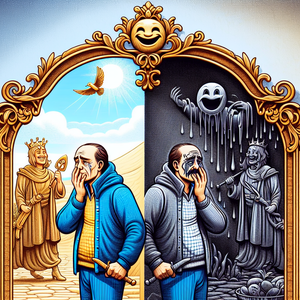

At the heart of Bitcoin's price volatility are two dominant emotions: fear and greed. These emotions often manifest in exaggerated forms in the cryptocurrency market, where rapid price shifts can evoke intense reactions.

Greed and Price Bubbles

Greed typically propels investors to buy during bullish market trends, leading to price surges that can create bubbles. A prime example of this phenomenon occurred in late 2017, when Bitcoin's price skyrocketed to nearly $20,000. This surge was fueled by rampant speculation and a herd mentality; many investors jumped on the bandwagon, fearing they would miss out on substantial gains. During this period, social media buzz and increased media coverage further stoked the flames of greed, prompting more people to invest even as the market showed signs of overextension.

Fear and Panic Selling

Conversely, fear can lead to panic selling during market downturns, exacerbating price drops. The 'crypto winter' of 2018 serves as a stark reminder of this dynamic, with Bitcoin's price plummeting to around $3,000. As prices fell, fear gripped investors, prompting them to sell off their holdings to cut losses, which in turn led to further declines. This cycle of fear and greed creates a feedback loop that often overshadows actual market fundamentals, driving prices based on emotional responses rather than rational assessments.

Herd Mentality and Social Influence

The herd mentality significantly influences Bitcoin trading behavior. Investors frequently look to the actions of their peers to inform their decisions, which can lead to synchronized buying or selling. Social media platforms, particularly Twitter and Reddit, have emerged as influential arenas where discussions and rumors can rapidly sway public sentiment.

The Power of Social Media

One notable instance of social media's impact occurred in early 2021 when a tweet from Elon Musk led to a dramatic surge in Dogecoin's price. This phenomenon demonstrated how influential figures can shape investor behavior and rapidly alter market dynamics. Similarly, the Reddit community WallStreetBets showcased the power of collective action, where coordinated buying efforts led to significant movements in stock prices. Bitcoin is not immune to such social influences; a few key voices can set trends that lead to rapid changes in investor sentiment, impacting price.

The Role of News and Market Sentiment

Bitcoin's price is highly sensitive to news events, which can elicit strong emotional responses from investors. Regulatory developments, technological advancements, and macroeconomic factors all play a crucial role in shaping market sentiment.

Impact of Regulatory News

For instance, when China announced crackdowns on cryptocurrency trading in 2021, Bitcoin's price experienced a sharp decline as fear spread through the market. Conversely, positive news such as increased institutional adoption or favorable regulatory developments often leads to price surges driven by optimism and the anticipation of future gains. Understanding how news influences market psychology can empower investors to make more informed decisions. By analyzing the emotional responses triggered by specific news events, investors can better navigate the volatile landscape of Bitcoin trading.

The psychology behind Bitcoin price fluctuations is a complex interplay of fear, greed, herd mentality, and external influences. Recognizing the emotional factors that drive investor behavior provides valuable insights into navigating the cryptocurrency market. As Bitcoin continues to evolve and attract a broader audience, understanding these psychological underpinnings will be crucial for both individual investors and market analysts. By adopting a more nuanced view of market psychology, investors can make informed decisions and potentially mitigate the risks associated with Bitcoin's inherent volatility. As we advance in this digital age, the interplay between human emotions and market dynamics will remain a pivotal factor in shaping the future of cryptocurrency trading.

Cryptocurrency Market Analyst

Core Responsibilities

Analyze market trends and investor sentiment to predict price movements of cryptocurrencies.

Create detailed reports on price fluctuations driven by psychological factors such as fear and greed.

Required Skills

Strong analytical skills with experience in data analysis tools (e.g., Python, R).

Understanding of market psychology and behavioral finance.

Common Employers

Cryptocurrency exchanges (e.g., Coinbase, Binance)

financial consulting firms

investment banks

Blockchain Behavioral Economist

Core Responsibilities

Conduct research on the psychological factors influencing cryptocurrency investments and trading behaviors.

Develop models to study the impact of news and social media on market dynamics.

Required Skills

Expertise in behavioral economics with a strong foundation in statistical analysis.

Familiarity with blockchain technology and cryptocurrency markets.

Common Employers

Academic institutions

think tanks

financial research organizations

Social Media Marketing Specialist (Crypto)

Core Responsibilities

Design and execute social media campaigns to influence public sentiment regarding cryptocurrency products.

Monitor and analyze trends in social media discussions to gauge investor sentiment and adjust strategies accordingly.

Required Skills

Proficiency in social media analytics tools and content creation.

Understanding of cryptocurrency markets and the psychological impact of social media on investor behavior.

Common Employers

Crypto startups

marketing agencies focused on fintech

established financial institutions venturing into cryptocurrency

Risk Management Analyst (Cryptocurrency)

Core Responsibilities

Identify and assess risks associated with cryptocurrency investments, focusing on volatility driven by market psychology.

Develop risk mitigation strategies that account for emotional market reactions.

Required Skills

Strong quantitative analysis skills and experience with risk management frameworks.

Understanding of emotional drivers in financial markets and their implications for risk assessment.

Common Employers

Hedge funds

investment firms

insurance companies specializing in crypto assets

Cryptocurrency Compliance Officer

Core Responsibilities

Ensure that cryptocurrency trading practices comply with regulatory standards, particularly those influenced by market sentiment and news events.

Monitor the effects of regulatory changes on market behavior and adjust compliance strategies accordingly.

Required Skills

In-depth knowledge of cryptocurrency regulations and compliance frameworks.

Ability to analyze how regulatory news affects investor psychology and trading patterns.

Common Employers

Financial institutions

cryptocurrency exchanges

regulatory bodies