The Psychology of Gold: Why People Invest in Precious Metals

To understand the psychological allure of gold, it is essential to consider its historical context. Gold has been revered across civilizations—from the ancient Egyptians, who buried their pharaohs with golden artifacts, to the Incas, who viewed it as the 'sweat of the sun.' Historically, gold has always been associated with prosperity and value. During times of crisis, such as wars or economic downturns, gold has often retained its worth when other assets falter. For instance, during the Great Depression in the 1930s, gold prices remained relatively stable compared to the plummeting stock market. This historical reliability reinforces the perception of gold as a 'safe haven,' an investment that can weather the storm of uncertainty. Even in today’s fluctuating economic climate, with gold prices experiencing notable spikes due to inflation and geopolitical tensions, its legacy as a secure asset continues to be validated.

Societal Perceptions and Cultural Significance

In many cultures, gold represents more than just an investment; it symbolizes wealth, success, and stability. In countries like India and China, gold is not merely a commodity but an integral part of social and cultural practices, such as weddings and festivals. In India, for example, it is customary to buy gold during auspicious occasions, solidifying its role in social status and familial bonds. The societal perception of gold as a prestigious asset influences individual investment decisions. When people see gold as a symbol of status, they are more likely to invest in it, particularly during times of economic distress when they seek to preserve their wealth. This cultural significance adds another layer to the psychological allure, as individuals may feel compelled to invest in gold not just for financial stability, but also to align with societal values and expectations.

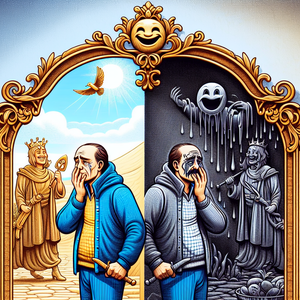

The Fear of Economic Instability

The psychological impact of fear cannot be overlooked when discussing gold investment. Economic instability often prompts a flight to safety, where investors seek refuge in assets that are perceived to be less volatile. The 2008 financial crisis serves as a prime example; during this period, gold prices surged as investors fled from stocks and real estate. The fear of losing money can drive individuals to seek out gold, reinforcing its image as a reliable store of value. This reaction can also be seen in the current economic landscape, where rising inflation and geopolitical tensions are leading many to reconsider their investment strategies. The growing uncertainty has prompted a renewed interest in gold, as individuals look for ways to safeguard their financial futures against potential downturns.

The Role of Cognitive Biases

Cognitive biases also play a significant role in the psychology of gold investment. One such bias is the 'loss aversion' phenomenon, where individuals prefer to avoid losses rather than acquire equivalent gains. This aversion can lead investors to prefer gold—an asset that has historically maintained its value—over riskier investments that could result in significant losses. Additionally, the 'herding effect' often seen in financial markets may compel individuals to invest in gold simply because others are doing so. As more investors flock to gold during uncertain times, its status as a safe asset is further solidified, creating a self-reinforcing cycle of demand.

Emotional Connection to Wealth

Gold’s intrinsic value and aesthetic appeal create an emotional connection that goes beyond mere investment. The sight of gold jewelry can evoke feelings of luxury and prosperity, making it a desirable asset for many. This emotional connection can influence investment decisions, as individuals may be more inclined to invest in something that resonates with their identity and aspirations. Moreover, the tangible nature of gold, as opposed to stocks or bonds, allows investors to feel a sense of ownership and security. This physical aspect of gold investment can provide a psychological comfort that abstract financial instruments cannot. For many, the act of holding gold is synonymous with holding wealth, reinforcing its importance in both financial and emotional contexts.

The psychology of gold investment is a complex interplay of historical significance, societal perceptions, emotional connections, and cognitive biases. As a time-honored symbol of wealth and security, gold continues to attract investors seeking stability in uncertain times. Understanding these psychological factors not only sheds light on why individuals gravitate toward gold but also highlights the enduring value of this precious metal in our lives. As economic landscapes evolve, gold remains a compelling choice for those looking to safeguard their financial future, driven by an age-old allure that transcends time and culture. With gold prices fluctuating in response to global economic conditions, the psychological factors driving investment decisions will continue to be a vital area of interest for both investors and psychologists alike.

Precious Metals Investment Analyst

Investment firms, financial advisory companies, and commodity trading companies

Core Responsibilities

Analyze market trends and economic indicators to forecast gold prices and investment opportunities.

Prepare detailed reports and presentations for clients on the performance of gold and other precious metals.

Advise clients on investment strategies tailored to their risk tolerance and financial goals.

Required Skills

Strong analytical skills with proficiency in financial modeling and data analysis tools.

Knowledge of macroeconomic factors affecting precious metals markets.

Excellent communication skills for client interaction and report presentation.

Gold Trading Specialist

Commodity exchanges, hedge funds, and proprietary trading firms

Core Responsibilities

Execute buy and sell orders for gold and other precious metals on behalf of clients or the firm.

Monitor real-time market conditions and adjust trading strategies accordingly.

Maintain relationships with key market players, including suppliers, brokers, and clients.

Required Skills

In-depth understanding of trading platforms and financial markets.

Ability to work under pressure and make quick decisions based on market fluctuations.

Strong negotiation skills and a keen awareness of geopolitical events impacting gold prices.

Financial Advisor Specializing in Alternative Investments

Wealth management firms, financial planning services, and private banks

Core Responsibilities

Provide clients with insights on diversifying their portfolios with alternative investments, including gold and other precious metals.

Conduct risk assessments and tailor investment strategies to meet client objectives.

Stay updated on market trends, economic conditions, and regulatory changes affecting alternative investments.

Required Skills

Strong background in financial planning and investment analysis.

Excellent relationship-building skills and client management experience.

Relevant certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

Economic Researcher Focused on Commodity Markets

Research institutions, think tanks, and financial services companies

Core Responsibilities

Conduct in-depth research on global economic trends and their impact on commodity prices, particularly gold.

Publish findings in reports, articles, and presentations for stakeholders and clients.

Collaborate with economists and financial analysts to enhance market predictions and investment strategies.

Required Skills

Strong quantitative and qualitative research skills, with proficiency in statistical software.

Ability to interpret complex economic data and present it clearly.

Familiarity with commodity market regulations and trading practices.

Marketing Manager for Precious Metals Firm

Precious metals companies, investment firms, and financial product marketing agencies

Core Responsibilities

Develop and implement marketing strategies to promote gold investment products and services.

Analyze market trends and consumer behavior to identify growth opportunities.

Manage public relations and communications to enhance the brand's reputation in the precious metals space.

Required Skills

Strong background in digital marketing and brand management.

Excellent communication and storytelling skills to effectively convey the value of gold investments.

Experience in market research and consumer insights specific to financial products.