The Rise of Credit One: A Deep Dive into Alternative Credit Solutions

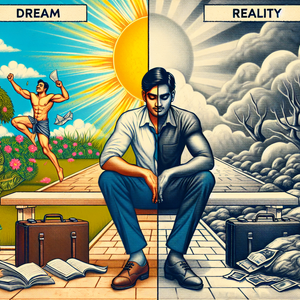

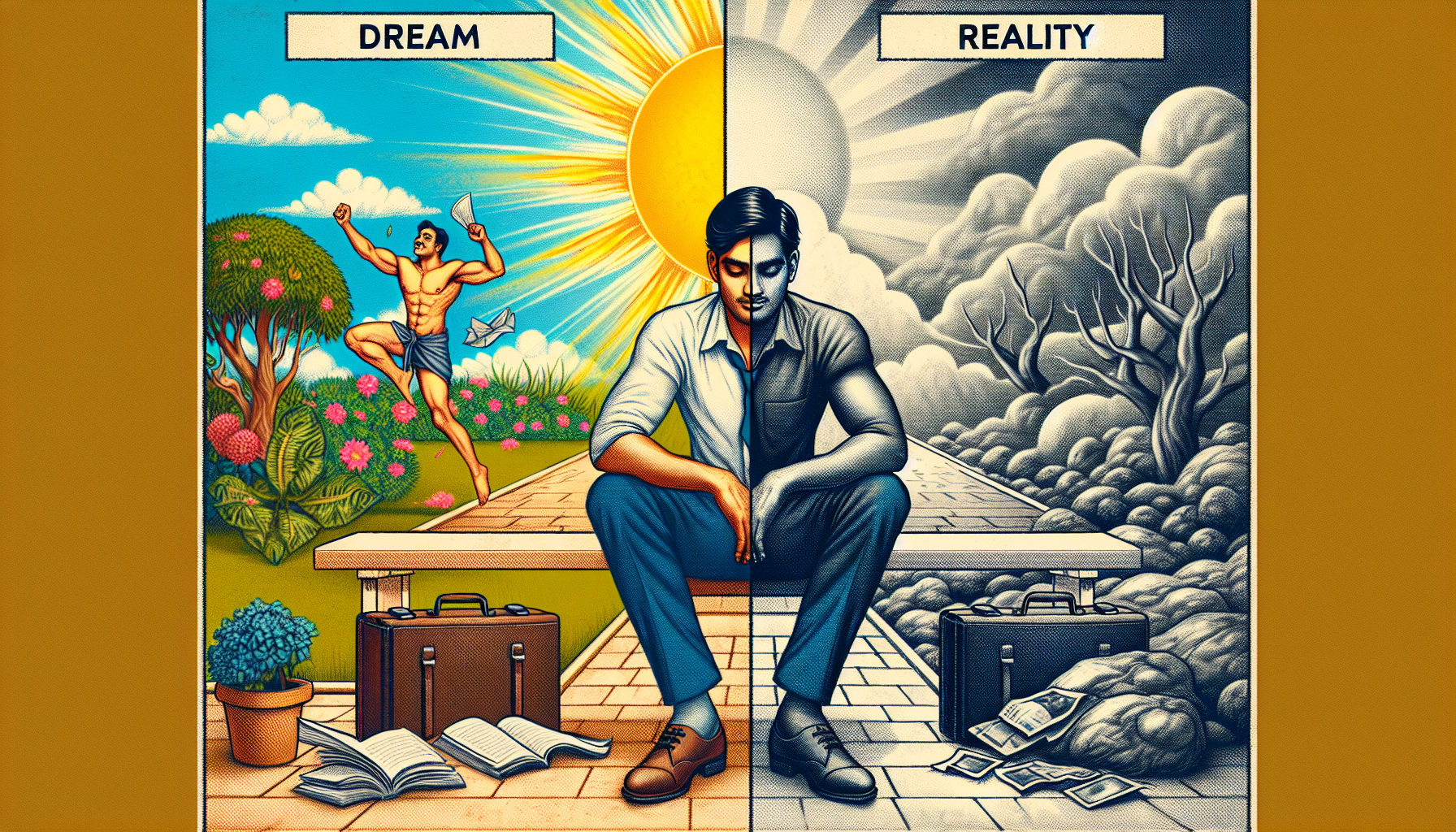

Credit One Bank specializes in credit cards tailored for consumers who may not qualify for traditional credit options. With a particular focus on individuals with subprime credit scores, Credit One provides a pathway for rebuilding credit history while offering essential features that promote financial responsibility. Unlike many traditional banks that often view lower credit scores as a risk, Credit One sees potential in these consumers, thus allowing them to access credit and improve their financial standing.

Case Study: The Cash Back Program

A notable example of Credit One's innovative approach is its cash back rewards program. Cardholders can earn anywhere from 1% to 5% cash back on eligible purchases, which can significantly enhance their purchasing power. This program not only incentivizes regular use of the card but also helps individuals who may struggle with budgeting to develop better financial habits. The opportunity to earn rewards while rebuilding credit creates a dual benefit that many consumers find attractive.

Financial Inclusion and Its Implications

Financial inclusion is a critical component of economic stability and individual empowerment. By providing credit options to individuals with less-than-perfect credit, Credit One is contributing to a more inclusive financial ecosystem. This approach helps consumers build or rebuild their credit scores and encourages responsible financial behaviors. As consumers gain access to credit, they can make significant purchases, such as a car or home, which contributes to long-term financial growth.

The Impact of Financial Literacy Programs

To further enhance financial inclusion, Credit One has also invested in financial literacy programs aimed at educating consumers about credit management. By providing resources that teach budgeting, responsible credit use, and the importance of maintaining a good credit score, Credit One empowers its customers to make informed financial decisions. This investment in education not only benefits the cardholders but also contributes to a healthier financial ecosystem overall.

The Role of Technology in Credit One's Success

Technology plays a pivotal role in Credit One's ability to serve its target market effectively. The bank leverages advanced algorithms and data analytics to assess creditworthiness, streamline the application process, and provide tailored solutions that meet the needs of its customers. This tech-driven approach enables Credit One to make more informed lending decisions while minimizing risks associated with lending to consumers with lower credit scores.

Example of Technological Integration

For instance, the use of artificial intelligence in transaction monitoring allows Credit One to detect potential fraud quicker than traditional systems. By continuously analyzing spending patterns, the bank can alert customers to suspicious activity, thereby enhancing security and building customer trust—a crucial factor for those who may be skeptical of banking institutions.

As the financial landscape continues to evolve, Credit One Bank stands out as a beacon of hope for individuals facing challenges in accessing credit. By focusing on alternative credit solutions and prioritizing financial inclusion, Credit One is not only meeting the needs of a vast demographic but also reshaping the credit industry. Its innovative approach, bolstered by technology and customer-centric offerings, sets a precedent for how financial institutions can adapt to serve a more diverse range of consumers.

Credit Risk Analyst

Credit One Bank, Capital One

Core Responsibilities

Analyze and evaluate credit data and financial statements to determine the risk associated with lending to potential borrowers.

Develop and implement risk assessment models to minimize losses while maximizing credit opportunities for subprime consumers.

Required Skills

Strong analytical skills and experience with statistical analysis software (e.g., SAS, R, Python).

Knowledge of credit scoring systems and the ability to interpret credit reports.

Financial Literacy Program Coordinator

Credit One Bank

Core Responsibilities

Design, implement, and evaluate financial literacy programs aimed at educating consumers about credit management and responsible financial behaviors.

Collaborate with community organizations to deliver workshops and seminars that enhance participants' financial knowledge.

Required Skills

Excellent communication and presentation skills, with experience in adult education or community outreach.

Familiarity with personal finance topics and the ability to convey complex information in an accessible manner.

Data Analyst in Financial Services

Credit One Bank

Core Responsibilities

Analyze consumer data to identify trends in credit usage and spending patterns, particularly among subprime borrowers.

Generate reports that inform strategic decisions around product offerings and risk management.

Required Skills

Proficiency in data visualization tools (e.g., Tableau, Power BI) and database management (SQL).

Strong understanding of data analysis techniques and experience with large datasets.

Product Manager for Consumer Credit Solutions

Credit One Bank

Core Responsibilities

Oversee the development and launch of new credit card products tailored to subprime consumers, ensuring alignment with market needs and company goals.

Conduct competitive analysis and customer feedback sessions to refine product features and benefits.

Required Skills

Strong project management skills with a background in financial services or consumer products.

Ability to think strategically while also being detail-oriented in execution.

Fraud Prevention Specialist

Credit One Bank

Core Responsibilities

Monitor transactions for unusual activity and investigate potential fraud cases involving credit card holders.

Collaborate with technology teams to enhance fraud detection systems and customer security measures.

Required Skills

Experience in fraud detection and prevention, with knowledge of cybersecurity best practices.

Strong analytical and problem-solving skills, with the ability to think critically under pressure.