The Rise of Flexible Work: A Deep Dive into Part-Time Insurance Sales

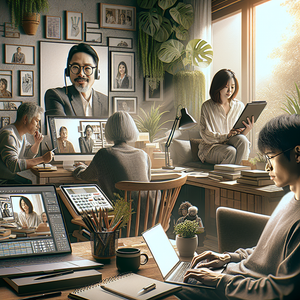

The gig economy is characterized by short-term, flexible jobs often facilitated by digital platforms, enabling individuals to pursue alternative work arrangements that support a better work-life balance. According to a report by McKinsey, nearly 30% of the U.S. workforce is engaged in some form of independent work. This trend has led many professionals to consider part-time insurance sales as a way to supplement their income while accommodating personal commitments, such as family care, education, or other entrepreneurial ventures.

Trends in Part-Time Insurance Sales

The part-time insurance sales sector is witnessing a variety of noteworthy trends that contribute to its rising popularity: 1. Increased Demand for Insurance Products: The shift toward digital platforms has resulted in a surge in individuals seeking insurance coverage tailored to their specific needs. Part-time sales agents are well-positioned to take advantage of this growing demand, catering to diverse clientele ranging from young professionals to retirees. The ability to work remotely and provide personalized service enhances the appeal of part-time roles in insurance. 2. Flexible Work Hours: The traditional 9-to-5 job is rapidly becoming a relic of the past. Insurance sales offer the flexibility to set personal schedules, allowing agents to balance work with other interests or responsibilities. This flexibility is particularly attractive to individuals who may have other commitments, such as taking care of children or pursuing further education. 3. Diverse Entry Points: Unlike full-time roles that often require extensive experience and specific qualifications, part-time insurance sales positions tend to be more inclusive. They welcome individuals from a variety of backgrounds, making it easier for college students, retirees, or those looking for a career change to enter the field. This diversity enriches the industry and fosters innovative approaches to sales.

Potential Income Benefits

While part-time roles may not provide the same level of financial stability as full-time positions, they can still be quite lucrative. The National Association of Insurance Commissioners reports that the average insurance sales agent earns a commission on every policy sold. For part-time agents, this commission structure can translate into substantial supplemental income, particularly for those who are proactive in their sales strategies. Moreover, many insurance firms offer performance-based incentives, which allow part-time agents to earn bonuses or higher commissions based on their sales performance. This commission structure encourages agents to maximize their efforts, providing an opportunity to increase earnings beyond initial expectations. For instance, a part-time agent who dedicates a few hours each week may find that their efforts lead to a significant income boost, especially during peak insurance seasons.

Changing Perceptions of Insurance Sales

Historically, insurance sales have been perceived as a full-time endeavor, often associated with high-pressure sales tactics and rigid working hours. However, perceptions are changing. Today, part-time insurance sales are increasingly recognized as a respectable and viable career path. The flexibility and work-life balance that these roles offer are becoming more widely acknowledged, attracting individuals who may not have considered insurance sales in the past. The rise of social media and professional networking platforms has also played a crucial role in reshaping perceptions. As more individuals share their success stories and highlight the flexibility of these roles, the stigma surrounding insurance sales is gradually fading. Part-time agents now have the opportunity to connect, share experiences, and celebrate their achievements, legitimizing the profession and inspiring others to consider similar paths.

The rise of flexible work arrangements has ushered in a new era for part-time insurance sales. With an increased demand for insurance products, the appeal of flexible hours, and the potential for supplemental income, these roles are becoming an attractive option for individuals seeking a harmonious balance between work and personal life. As perceptions continue to evolve and the gig economy expands, part-time insurance sales are well-positioned to thrive, offering opportunities for personal growth and financial stability in an ever-changing job market. Whether you are a seasoned professional or a newcomer exploring your options, the part-time insurance sales landscape holds significant promise for those willing to engage with its possibilities. The adaptability of this field not only meets the needs of a modern workforce but also opens doors for individuals looking to create a fulfilling and flexible career.

Part-Time Insurance Sales Agent

Allstate, State Farm, Geico

Core Responsibilities

Build and maintain client relationships to identify their insurance needs and tailor suitable products.

Conduct market research to stay informed about competitive offerings and adjust sales strategies accordingly.

Process insurance applications and ensure compliance with industry regulations.

Required Skills

Strong communication and interpersonal skills to effectively engage clients.

Basic knowledge of insurance products and sales techniques.

Ability to work independently and manage time effectively.

Remote Insurance Customer Service Representative

Progressive, Liberty Mutual, Farmers Insurance

Core Responsibilities

Provide assistance to clients over the phone or via online chat regarding policy inquiries and claims.

Resolve customer complaints by identifying issues and providing appropriate solutions.

Maintain detailed records of customer interactions and transactions.

Required Skills

Excellent problem-solving and conflict-resolution abilities.

Proficiency in customer relationship management (CRM) software.

Strong organizational skills and attention to detail.

Insurance Claims Adjuster (Part-Time)

Allstate, AIG, Zurich Insurance

Core Responsibilities

Investigate and analyze insurance claims to determine liability and assess damages.

Communicate with policyholders, witnesses, and experts to gather relevant information.

Prepare reports and make recommendations for settlement based on findings.

Required Skills

Strong analytical skills and attention to detail for accurate assessments.

Proficient in negotiation and conflict resolution.

Familiarity with legal guidelines and insurance policies.

Insurance Marketing Specialist

Nationwide, MetLife, Travelers Insurance

Core Responsibilities

Develop and execute marketing campaigns to promote insurance products to targeted demographics.

Analyze market trends and consumer behavior to refine marketing strategies.

Collaborate with sales teams to create promotional materials and digital content.

Required Skills

Strong knowledge of digital marketing tools and social media platforms.

Creative thinking and ability to generate innovative marketing ideas.

Excellent written and verbal communication skills.

Insurance Broker (Part-Time)

Marsh & McLennan, Aon, Brown & Brown Insurance

Core Responsibilities

Act as an intermediary between clients and insurance companies to find the best coverage options.

Assess client needs and provide tailored insurance advice and recommendations.

Stay updated on industry trends and changes in insurance regulations.

Required Skills

Strong negotiation skills and a comprehensive understanding of various insurance products.

Ability to build and maintain a network of contacts within the insurance industry.

Licensing in relevant states, as required.