Turning Your SEC Expertise into a Thriving Side Hustle

The concept of a side hustle has gained immense traction in recent years, especially as professionals seek to supplement their income, explore entrepreneurial opportunities, and develop new skills outside traditional employment. For former SEC professionals, the benefits of starting a side hustle include diversified income streams, personal brand development, creative freedom, and networking opportunities. The depth and breadth of your expertise make you uniquely positioned to capitalize on side hustles in compliance, financial education, and consulting.

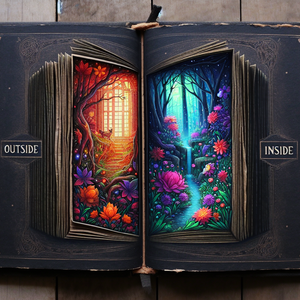

Writing a Compliance-Focused Book or E-book

One of the simplest yet most impactful ways to monetize your SEC experience is by writing a book or e-book. Potential topics include regulatory compliance basics, case studies, and specialized areas like cryptocurrency regulation. Platforms like Amazon Kindle Direct Publishing (KDP) or Gumroad make publishing and selling your book accessible and profitable.

Launching a Compliance Blog or Podcast

Starting a blog or podcast is a rewarding way to educate others and generate income. A compliance-focused blog allows you to publish articles, whitepapers, or thought pieces, while a podcast can cover topics like regulatory changes or compliance trends. Monetization options include ads, sponsorships, and premium content.

Offering Freelance Compliance Services

Many businesses lack the resources to hire full-time compliance professionals but need guidance to stay aligned with regulatory requirements. Services you can offer include audits, policy development, and workshops. Platforms like Upwork and LinkedIn can help market your services.

Creating Online Compliance Courses

The e-learning industry provides excellent opportunities to monetize your knowledge. Course ideas include beginner-friendly introductions to SEC compliance, advanced practices, and industry-specific compliance. Platforms like Udemy and Teachable make it easy to create and sell courses.

Selling Compliance Templates and Tools

Designing ready-to-use templates and tools can fill a gap for small businesses and startups. Examples include policy templates, compliance checklists, and spreadsheet tools. These products can be sold on platforms like Etsy, Gumroad, or your own e-commerce site.

Hosting Compliance Workshops or Speaking Engagements

If you have a knack for public speaking, consider offering workshops or speaking at conferences. Opportunities include partnering with local organizations, offering corporate training, or speaking at industry events. This approach generates income and boosts your visibility as a compliance expert.

For former SEC professionals, a side hustle is not just a way to earn extra income—it’s an opportunity to leverage your unique skills to create something impactful, rewarding, and sustainable. By identifying your niche and starting small, you can gradually build a thriving side hustle that complements your career while offering freedom, creativity, and financial stability.

Regulatory Compliance Consultant

Big Four accounting firms (e.g., Deloitte, PwC), Risk and compliance consulting firms like Protiviti or FTI Consulting

Responsibilities

Conduct risk assessments and ensure adherence to financial regulations such as SEC, AML, or GDPR.

Develop and implement compliance frameworks tailored to specific industries (e.g., fintech, healthcare).

Provide strategic guidance during regulatory audits or investigations.

Required Skills

Expertise in federal securities laws, corporate governance, and reporting requirements.

Strong analytical skills to assess risks and recommend actionable solutions.

Experience with compliance software tools and technologies.

Financial Fraud Investigator

Federal agencies (e.g., FBI, SEC), Financial institutions like JPMorgan Chase or Goldman Sachs

Responsibilities

Investigate potential fraud, insider trading, and other financial crimes.

Analyze large datasets to identify unusual transaction patterns or discrepancies.

Collaborate with legal and compliance teams to report findings and recommend preventive measures.

Required Skills

Proficiency in forensic accounting and data analytics tools (e.g., Excel, SQL, Python).

Deep understanding of SEC enforcement policies and financial regulations.

Strong investigative and interpersonal skills to interview stakeholders and gather evidence.

ESG (Environmental, Social, and Governance) Compliance Specialist

Publicly traded companies or private equity firms, ESG-focused consulting firms or NGOs

Responsibilities

Develop ESG policies and reporting mechanisms to meet regulatory and investor demands.

Monitor evolving ESG regulations and ensure corporate adherence to disclosure standards.

Advise on sustainable investment strategies and risk management.

Required Skills

Knowledge of ESG frameworks like SASB, TCFD, and GRI.

Familiarity with SEC-related ESG disclosure requirements.

Strong communication skills to present ESG initiatives to stakeholders.

Cryptocurrency Compliance Officer

Crypto exchanges (e.g., Coinbase, Binance), Blockchain startups or financial technology firms

Responsibilities

Oversee compliance with SEC regulations and state laws related to cryptocurrency and blockchain.

Develop policies to prevent money laundering, fraud, and other financial crimes in crypto transactions.

Liaise with regulators and maintain up-to-date knowledge of legal developments in the crypto space.

Required Skills

Expertise in cryptocurrency regulations and blockchain technology.

Experience with AML/KYC frameworks in a fintech or crypto environment.

Familiarity with tools like Chainalysis or Elliptic for transaction monitoring.

Risk and Compliance Trainer

Corporate compliance departments, Training firms like Thomson Reuters or LRN

Responsibilities

Design and deliver compliance training programs for corporate teams or industry professionals.

Create educational materials on topics like SEC filings, AML protocols, or cybersecurity compliance.

Assess training effectiveness and update content to reflect new regulations.

Required Skills

Strong public speaking and instructional design skills.

In-depth knowledge of regulatory frameworks and industry-specific compliance needs.

Ability to simplify complex regulations for diverse audiences.